-

- MeetSpa Admin Team

- Business Resources

- April 12, 2025

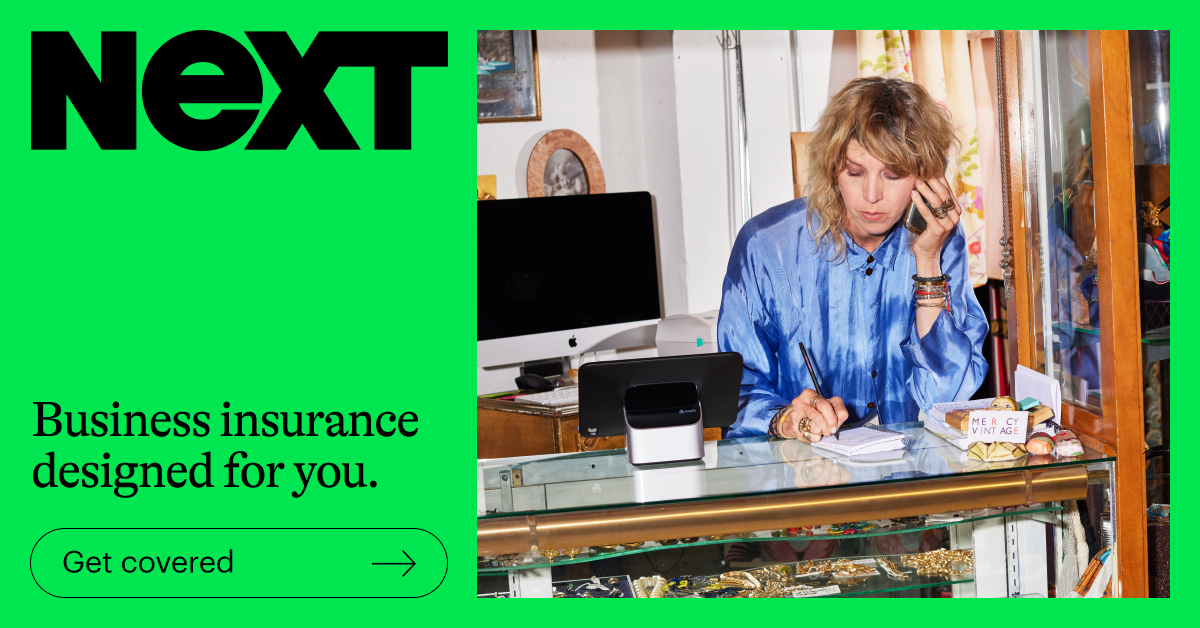

For beauty professionals using MeetSpa, having the right insurance is essential to protect your business from unexpected risks. Whether you're a hairstylist, nail technician, esthetician, or barber renting short-term spaces across multiple cities, you need a flexible and affordable insurance solution that moves with you. That’s where NEXT Insurance comes in.

NEXT is an online insurance provider dedicated exclusively to small businesses and self-employed professionals. Their tailored policies ensure that beauty professionals, salon owners, and independent stylists get just the right coverage without paying for unnecessary extras.

Why MeetSpa Professionals Need NEXT Insurance

MeetSpa enables beauty professionals to travel and work in multiple locations, often renting short-term spaces rather than committing to a single salon. While this flexibility is great for business, it also presents unique risks. Many salon owners require renters to have liability insurance, and working in different locations means being prepared for potential claims, from accidental injuries to property damage.

With NEXT Insurance, you can get affordable and customized coverage to meet these requirements, protecting yourself and your business wherever you go. Their policies cater to independent professionals who need seamless coverage without complex paperwork or hidden fees.

Get a quote with NEXT Insurance today.

Comprehensive Coverage Tailored for Beauty Professionals

NEXT Insurance offers various types of coverage, ensuring that beauty professionals using MeetSpa have protection tailored to their specific needs:

- General Liability Insurance – Covers claims related to bodily injuries, property damage, and third-party accidents. Essential for beauty professionals working in different salons and rented spaces.

- Professional Liability Insurance (E&O) – Protects against claims of negligence, mistakes, or unsatisfactory services, ideal for hairstylists, makeup artists, and estheticians.

- Business Owner’s Policy (BOP) – Combines general liability with commercial property insurance for salon owners or professionals who own equipment and rent spaces.

- Workers' Compensation – Required in many states for business owners with employees, covering medical expenses and lost wages due to work-related injuries.

These policies are available as monthly subscriptions or on-demand coverage, allowing you to adapt your insurance to your business’s needs.

How NEXT Insurance Benefits MeetSpa Users

- Affordable and Flexible Plans – Whether you’re renting a chair for a day or managing your own beauty studio, NEXT Insurance offers cost-effective solutions that fit your budget.

- Instant Coverage with No Hassle – Get insured in minutes with an entirely online process, ensuring you’re covered before your next client appointment.

- Customizable Policies – Adjust your coverage as your business grows, whether you're expanding services or working in multiple locations.

- Proof of Insurance on Demand – Many salons and clients require proof of insurance. With NEXT, you can generate a Certificate of Insurance (COI) instantly from your phone.

- Peace of Mind for Traveling Professionals – Since MeetSpa allows beauty professionals to work across different states and cities, having portable coverage ensures protection wherever your business takes you.

Real-World Scenarios for MeetSpa Professionals

Scenario 1: You’re a traveling hairstylist who books salon spaces through MeetSpa in multiple cities. One day, a client trips over your styling tools, injuring themselves. With General Liability Insurance from NEXT, you’re covered for medical expenses and legal fees, preventing financial loss.

Scenario 2: You’re a nail technician providing services in different beauty studios. A client claims that a nail treatment caused an allergic reaction, threatening legal action. Professional Liability Insurance (E&O) protects you from claims of negligence or harm caused by your services.

Scenario 3: You rent a private suite through MeetSpa and bring in expensive equipment. A small electrical fire damages some of your tools. With a Business Owner’s Policy (BOP), you’re covered for property damage and business interruptions.

How to Get Started with NEXT Insurance

- Get a Quote Online – The process is quick and easy. Simply enter your business details to receive a customized quote.

- Select Your Coverage – Choose a policy that fits your needs, whether it's general liability, professional liability, or a combination.

- Instantly Activate Your Insurance – Once you purchase, your coverage is active, and you can download your Certificate of Insurance immediately.

- Stay Protected as You Grow – Modify or upgrade your coverage at any time as your beauty business expands.

Beauty professionals using MeetSpa need an insurance provider that understands their industry and the way they work. NEXT Insurance delivers affordable, tailored, and flexible coverage designed specifically for self-employed professionals and small businesses. Whether you’re working in a new salon space every week or managing your own independent beauty brand, NEXT has the coverage to keep you protected anytime, anywhere.

Don’t let unexpected incidents slow down your business. Get insured today and focus on what you do best—serving clients and growing your brand with MeetSpa.

💬 Leave a Reply